What is ETF?

By WB Loo | 2023-01-24

This page may contain some affiliate links. This means that, at no additional cost to you, Alpha Investing Group will earn a commission if you click through and make a purchase. Learn more

As the financial system continues to decentralize, we are exposed to different financial products almost every day. Moreover, these financial products are getting increasingly complex and bewildering. Among them, ETF is one of the most powerful and most widely used financial products. You have probably heard of ETF, but do you know what an ETF is? And how does this financial product work? Worry not, read this now, and we will answer all the questions you have about ETF in no time.

What is ETF?

An exchange-traded fund (ETF) is a type of security that involves a collection of securities, similar to a mutual fund, that often tracks an underlying index. Imagine the stock market as a bar, and each stock is a type of liquor. For instance, whiskey is Apple, vodka is Meta, and so on. When you buy a stock in the stock market, you are purchasing a type of liquor from the bar. However much you like whiskey, sooner or later, you probably want to try something else, like vodka. After that, you might also want to try brandy and gin. The barkeeper knows that, and hence he decided to offer you cocktails, allowing you to mix and enjoy the taste of different liquor at the same time. The cocktail is the ETF.

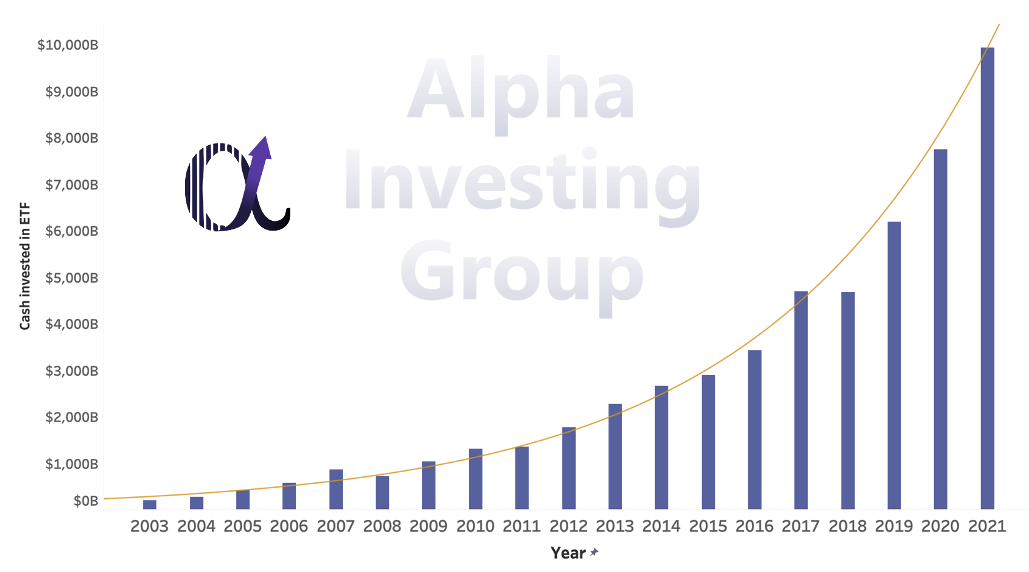

The interest in ETFs has grown rapidly since their invention in the early 1990s, partly driven by the increased adoption of index-based investing. Looking at Figure 1, we can tell that the money flowing into ETF has grown exponentially. Thus, it is essential for investors to understand how ETFs work and, more importantly, how to invest in them.

Figure 1: Cash invested in ETF, source: Reuters

Types of ETF

As the ETF industry grows, different types of ETFs have been created by ETF providers, such as iShares, Vanguard, State Street SPDR, etc. There are various types of ETFs available out there, and they all have different dynamics. Here, we introduce the five most common types of ETFs that you will most likely come across in your investment journey.

Figure 2: The 5 main types of ETF, source: Alpha Investing Group

-

Equity ETF

These ETFs track equity indices or sectors by either representing their entirety or using representative sampling. They provide investors with an easy way to achieve diversification. Whether you are looking to invest in all of the companies in the US, companies in a particular sector or geographical area, or even companies in a specific niche market such as clean energy or robotics, you can easily do it all by investing in the right equity ETF. VOO, an ETF created by Vanguard to track the S&P 500 index, is one of the most famous equity ETFs. Some equity ETFs like the VUSA will even distribute dividends to their investors.

-

Fixed Income ETF

Most financial professionals recommend that every investor invest a portion of their portfolio in bonds. Fixed income ETFs can be seen as bond ETFs. They allow investors to invest in different types of bonds easily. Furthermore, unlike buying bonds through banks, which will require you to have a certain amount of minimum investment, you can start investing in bonds with just as little as $1 with fixed income ETFs.

-

Commodity ETF

Historically, commodities have a low price correlation with equities. Hence, they provide good diversification to your portfolio. If you understand its economics, investing in commodities can help you create a more robust portfolio. Commodity ETFs track the price changes in commodities, such as crude oil and gold. Investors can thus invest in these ETFs to get exposure to commodities easily.

-

Currency ETF

Currency ETFs can be the perfect option for investors looking to hedge their portfolios against foreign currency risks. It is, however, critical to note that currency investing is only meant to soften the currency volatility in your portfolio. Thus, it should only represent a small proportion of your portfolio.

-

Inverse ETF

These ETFs are constructed using various derivatives to allow investors to profit from a decline in the value of the underlying assets or indices. Investing in such ETFs is similar to shorting the underlying assets or indices. Speculative investors generally use this to short the market at a relatively low cost. Also, investing in inverse ETFs allows investors to have a short position without needing a margin account.

ETF vs. Mutual Fund

Although many ETFs are organized under the same regulation as mutual fund products, there are essential differences between them that every investor should comprehend. So, let’s analyze ETF vs. mutual fund with the following factors:

-

Minimum Initial Investment: If you are worrying about minimum initial investment, then you would love ETFs. A share of an ETF can be as low as $50 (or even lower). This is extremely low compared to the average minimum initial investment in mutual funds of about $1,000 to $3,000. Plus, most investing platforms now allow you to buy a fraction of an ETF share. This means you can start investing in ETF for as low as $1!

-

Traded: The most distinct difference between an ETF and a mutual fund is that the shares of an ETF are listed and traded on exchanges, while the shares of a mutual fund do not.

-

Management Style: Almost all mutual funds are actively managed, whereas ETFs are mostly passively managed. Investing in actively managed funds can pose a higher risk as you are inherently betting on the portfolio managers to make the right investments.

According to the S&P Dow Jones Indices’ annual report published in 2019, although it is possible for a mutual fund to outperform the S&P 500 for a year or two, more than 85% of the mutual funds underperform the index. If we look further into 15-years performance, almost 92% of mutual funds are trailing the index. You can easily beat most savvy fund managers by investing in lost-cost ETFs with a long-term mindset. Not bad, right? To know more about passive investing, check out our blog: What is passive investing?

-

Fees: Since mutual funds are actively managed, they usually charge a higher fee of 0.5% to 2.5%. The numbers may not seem high. However, if you compare them to the ETF’s expense ratio of 0.05%, that’s about 10 times higher. Some ETFs even have expense ratios as low as 0.04%, such as the VOO, the S&P 500 ETF.

Advantages of ETFs

Now you understand what ETFs are, but why should you invest in ETFs? There are reasons money is increasingly pouring into ETFs. Here are some of the more prominent advantages of ETF investing:

-

Low fees: ETFs, which are mostly passively managed, generally have a very low expense ratio compared to other funds. This is because the money that goes into management fees and shareholder accounting expenses can all be surpassed.

-

Diversification: ETFs give you exposure to a group of equities or assets by either tracking an index or attempting to mimic the returns of a particular group of securities. This allows you to easily diversify your portfolio without having to buy every stock or asset individually.

-

High liquidity: As ETFs are actively traded on exchanges, most of them enjoy high liquidity. It is usually very easy and straightforward to sell your shares of an ETF on the exchanges and get your cash back.

-

Tax-efficient: ETFs are generally more tax-efficient compared to mutual funds. Since ETFs are passively managed, they tend to realize fewer capital gains. This, thus, leads to a significant decrease in capital gains tax. Also, when you buy or sell ETF shares, it is considered in-kind redemption hence does not result in a tax charge.

Disadvantages of ETFs

As amazing as ETF is, it has some downsides that every investor should also be aware of before dabbling into ETF investing. Some disadvantages of investing in ETF include:

-

Tracking error: Tracking error is the divergence between the share price behavior of an ETF and its underlying index. This can be very common for ETFs using complicated financial instruments, such as derivatives to mimic the return of its underlying index. Tracking error is very dangerous, especially for inexperienced investors.

Imagine this: You put your savings in an ETF that tracks the NASDAQ 100 index, thinking it would perform like the index itself. However, one year later, you realize the return you get from it is 10% less than the actual index. That’s not good, is it?

-

Function like a “black box”: Many investors do not check the holdings and respective weightings of the ETFs they invest in. This behavior thus makes ETF seems like a “black box” containing several securities not known to the investors. This can have a serious impact on your portfolio if you invest in something that you don’t fully understand; as Warren Buffet once said, ‘Risk comes from not knowing what you are doing.’

-

Potential low trading volume: Due to the popularity of ETFs, ETF providers have been rolling out tons of different ETFs. Although most popular ETFs enjoy high trading volume and high liquidity, some “niche” ETFs have a very low trading volume that can lead to low liquidity. If you are a beginner in ETF investing, I strongly recommend starting with ETFs with high liquidity and trading volume.

How to start investing in ETF?

Are you already thinking about investing in ETF? That’s great! We have got you covered. Investing in ETF may be a lot simpler than you might think. All you need to do are the following three steps:

-

Find an investing platform

To start investing in ETF, first of all, you need to find an investing platform that gives you access to the stock market. Nowadays, this step is incredibly easy to achieve as there are dozens of platforms out there that provide this service.

For investors based in the U.S., here are some of the best platforms to explore:

For investors based in the U.K., these platforms can help you get started:

For international investors, we recommend you try Etoro, Trading 212, or WeBull. They are widely available in most countries.

-

Research and understand how ETF works

The next step is to understand what ETFs are and how it works. But well, you are already doing it now. If you have finished reading this article and understand it by heart, you should already have a good understanding of this financial product.

However, there is no reason to stop here. If you want to be successful in investing in ETF, there is no other way than continuous learning. In my opinion, there is no better way to do this than reading. So, if you want to learn more about investing, go ahead and explore the books that we recommend. I have also prepared an article where I handpicked some books which are my personal favorites.

-

Have an investing strategy

No matter how amazing ETF is, it needs to fit nicely into your overall investing strategy for it to serve you well. The ultimate question for you is: What are you trying to accomplish by investing in ETF? Answering this question will also help you choose the right ETF type to invest in.

-

If you are using ETF for index investing, you might want to focus on ETFs with a low expense ratio. For instance, the VOO, the S&P 500 ETF by Vanguard, is a good choice with a low expense ratio of 0.04%, whereas SWDA by iShares, which tracks the MSCI World Index, has an expense ratio of 0.2%.

-

Suppose you are looking to hedge inflation with ETF. In that case, you might want to look at commodity ETF, such as gold ETF like GLD and crude oil ETF like USO, or fixed income ETF such as the AGG that tracks most of the U.S. investment-grade bonds.

-

Currency ETF might be a good fit for your portfolio if you are looking to hedge your foreign currency exposure. Some good examples are UUP by Invesco, which tracks the U.S. Dollar Index, and the famous BITO, the first-ever Bitcoin ETF.

-

And of course, you can also use ETF to get exposure to a niche sector or a geographical area you believe in. For instance, if you think robotics and automation are the future, you might want to look into ARKQ, and if you are into crypto, you can put your money into BITO, the Bitcoin ETF. In terms of investing based on geographical area, SWDA allows you to invest in global stocks by tracking the MSCI World Index, whereas VWO allows you to invest in just emerging markets.

Besides the investment strategies mentioned above, there are still many more investment strategies that you can implement with ETF. To learn more about investment strategies, check out this article on best investment strategies to learn for beginners.

-

-

Put your money in!

Well, if you have completed the previous three steps, what are you waiting for? You should have already chosen your investing platform, understood the dynamics of ETF and how it fits with your investing strategy. So, select and choose the right ETF and start investing now! And enjoy the journey!

ETF Investment Checklist

You should now possess enough knowledge to start investing in ETF. Before you go, we want to leave you with a checklist that you can use when investing in ETF. Before you put money in any ETF, make sure you check the following:

-

Holdings and their corresponding weightings: Knowing what you are investing your money in is the most important thing. Remember, risks come from not knowing what you are doing. So, before you put your money into an ETF, make sure you understand the ETF’s holdings and their respective weightings.

-

Tracking error: As mentioned above, tracking errors can occur if the ETF uses some complicated financial instruments or engineering to mimic the return of the underlying assets. Investing in an ETF with tracking errors can be disastrous. This is because you might think you are using the ETF to invest in a particular index while the actual returns may differ significantly. This will heavily impact the expected return and the risk profile of your investments.

-

Trading volume: It is critical to check the trading volume before investing in an ETF as it directly impacts the liquidity of your investment. If you got into an ETF with a low trading volume and hence low liquidity, you may not be able to sell your investments when you want to cash out.

-

Net asset value (NAV): Having a high net asset value generally means high liquidity since more investors are investing in the ETF. Although high NAV does not necessarily mean that it is a good investment, it indicates that there is enough public interest and recognition.

If you are interested in learning more about investing in ETF (you should!), we have a few recommended resources for you. Check it out:

- The ETF Handbook: How to Value and Trade Exchange Traded Funds by David J. Abner

- The Little Book of Common Sense Investing by John Bogle

- Investing in ETF for Dummies by Russell Wild