What is Passive Investing?

By WB Loo | 2022-07-25

This page may contain some affiliate links. This means that, at no additional cost to you, Alpha Investing Group will earn a commission if you click through and make a purchase. Learn more

What’s the best way to invest? This is probably one of the most asked questions in the world of investing. More often than not, the answers you will hear are complex investment strategies like growth investing or value investing. It makes sense since it is totally reasonable to assume that you can only earn great returns if you understand and apply sophisticated strategies. There’s no free lunch after all, right?

Surprisingly, the best way to invest suggested by legendary investors such as Warren Buffet and John Bogle is actually passive investing. In fact, Warren Buffet said that 99% of investors should not even attempt to beat the market and would be much better off investing in a low-cost S&P 500 index fund passively.

If you are wondering how passive investing can be the best investment strategy, worry not, as this is precisely what we will talk about here today. Continue reading, and explore the best passive investment strategy.

What is Passive Investing? The Passive Investing Definition

Passive investing is perhaps the easiest and most straightforward investment strategy of all. By fully utilizing the power of compounding interest, it focuses on growing wealth in a slow yet consistent manner. Passive investors do not attempt to beat the market. Instead, they are content to earn the market return and usually buy and hold their investment for a long time. In general, passive investors will choose to invest in well-diversified indices such as the S&P 500.

Active vs. Passive Investing - The Strengths and Limitations of Passive Investing

To kick things off, let's take a look at passive investing's strengths, limitations, and the differences between active and passive investing.

Strengths of passive investing

-

Passive investments require low fees

The purpose of active investing is to beat the market and achieve higher returns than the market average. You need to pay someone to manage your money actively and conduct deep and complex analysis to arrive at the right investment decision. Hence, active investing is relatively expensive.

As passive investing aims to earn the market return, not to beat it, relatively little analysis needs to be done to invest. This makes passive investing one of the most cost-effective investment strategies.

-

Passive investment strategy is highly transparent

The transparency in active investing is low as it is difficult to track the portfolio's holdings since they are constantly changing. On the other hand, it is easy to keep track of your passive investment portfolio as they are relatively stable. Plus, the holdings of index funds are also widely available.

-

Passive investments are tax-efficient

Active investing often requires frequent buying and selling, incurring high capital gain taxes. At times, the short-term capital gain tax rate can even exceed 20%. Passive investing is very tax efficient as relatively few transactions are carried out.

Limitations of passive investing

-

Lack of flexibility in passive investing

For active investing, there is no rule attached. Portfolio managers can apply any strategies they think will beat the market. In contrast, passive investing does not offer customization. In most cases, investors cannot affect the holdings of an index fund.

-

Passive investment strategy has limited risk management options

The options to manage risks are very limited for passive investors. Active investors, on the other hand, are allowed to apply complex risk hedging strategies. For instance, active investors can hedge their investment risk using put options or short sales.

Why beating the market is a loser's game?

After understanding the passive investing definition, let’s explore a fundamental principle that most passive investors believe – trying to beat the market is a loser’s game. Although it may sound absurd since there are so many well-known active investors out there that seem to be beating the market constantly, there are actually some logical explanations to this assertion.

In fact, this assertion is explainable by a simple math statement. Mathematically speaking, before deducting the cost of investing, investors as a group must necessarily earn precisely the market return. This is the undeniable reality of investing.

So, after subtracting the cost of any financial intermediary, the return of investors as a group must, and will, always fall short of the return of the market.

Hence, this brings us two certainties.

- Before costs, beating the market is a zero-sum game.

- After costs, beating the market is a loser’s game.

This is a very logical, mathematical deduction.

Why Passive Investing is The Best Way to Build Your Wealth?

So, why should you care about passive investing?

-

Passive investing requires minimal time investment

Since you are passively putting your money into the investment, which is usually a well-diversified index fund, not much time will be needed to maintain your investment once you chose the right index fund. You can get on with your life and allow your money to earn you some investment income.

-

Passive investing requires no investment skills or knowledge

Well, if you are buying the market, you don't necessarily need to equip yourself with any investment-related skills and knowledge. Interested in knowing if you are financially literate? Check out our financial literacy test now!

-

Passive investing can achieve amazing results

Passive investing makes excellent use of compounding interests to achieve unbelievable results. Say, starting from today, you put $50,000 into an S&P 500 index fund and continue to put $500 each month into the fund. Assuming an average annual return of 10%, your $50,000 would have turned into $230,728.80 after ten years. By doing nothing besides chucking your money into an index fund, you earned an extra $120,415.92 as interest! Can you imagine that?

Figure 1: The Results of Passive Investing — The Power of Compounding Interest, sources: Alpha Investing Group

Figure 1: The Results of Passive Investing — The Power of Compounding Interest, sources: Alpha Investing Group

How should you invest passively? The Best Passive Investing Ideas

It is not difficult at all to be successful in passive investing. In fact, there are only two principles that you need to keep in mind to achieve success in passive investing.

Focus on low-cost funds

In passive investing, cost or fee is one of the most essential factors in deciding the returns investors get. But what costs do investors normally pay?

There are three types of fees that investors normally pay:

-

Expense ratio

The first and most significant cost is the fund’s expense ratio, also known as the annual operating fees. It is the annual fee that funds charge the investors for its operation. It often expresses in percentage terms, representing the percentage of assets deducted in each fiscal year for the fund’s expenses, such as management fees, administrative fees, operating costs, and so on.

-

Sales charge

Secondly, the sales charge paid on every purchase or sale of shares for fund ownership is also a considerable component of the cost. There are usually two types of sales changes. The front-end sales charge is incurred when the investors purchase shares from a fund. On the other hand, the back-end sales charge, also commonly known as the redemption fee, is incurred when shares are sold by the investors.

-

Turnover cost

The third cost is the turnover cost incurred when portfolio managers alter their portfolios by buying and selling stocks in the market. Transaction fees and potential taxable events cut into the investors' profits when turnover happens. As fund managers are only paid to make trades on your behalf, they are not incentivized to make you profit. They might increase the number of trades just to heighten the gross return.

Now, let's see why focusing on low-cost funds can bring you high returns.

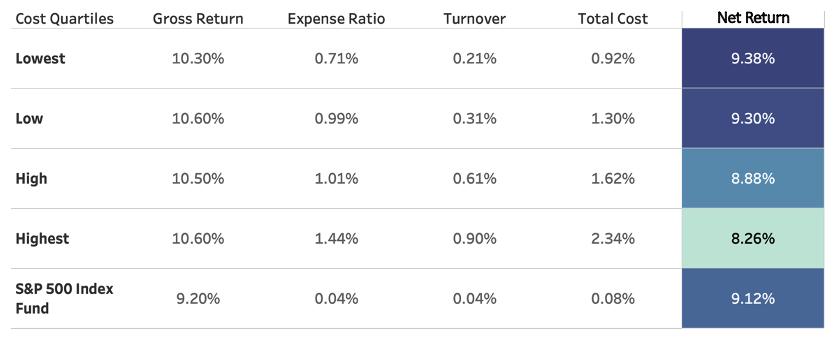

In Table 1, it is shown that expense ratios of equity mutual funds range from 0.04% to around 1.5%, and the total costs range from approximately 0.1% to 2%.

Figure 2: Returns vs. costs for equity mutual funds and S&P 500 index fund, source: The Little Book of Common Sense Investing

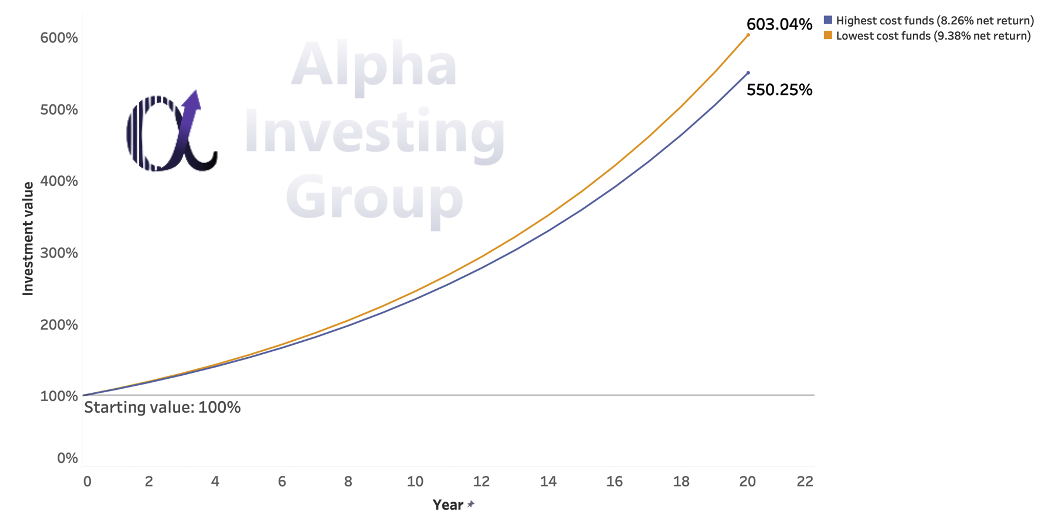

The total cost difference between the highest and lowest quartile is about 1.4%, and the difference between net returns is about 1.1%. 1.4% and 1.1% maybe not seem a lot. But compounding over ten years, the impact is stunning! This is shown evidently in Figure 1.

If you invest $10,000 in both the lowest and highest costs funds, assuming the net return is 9.4% and 8.9% annually, your investment in the highest cost fund would have been $311,674 less. And this is only for ten years. Imagine what would happen if you invest for your retirement that is 30 years to 50 years away.

Figure 3: Comparison of performance between the lowest-cost funds and the highest-cost funds, source: Alpha Investing Group

This has shown us one critical piece of information – higher costs do not bring higher returns. On the contrary, funds with higher costs often underperform their lower-cost counterparts.

Reinvest your dividends

If costs are your worst enemies in investing, dividends are your best friends.

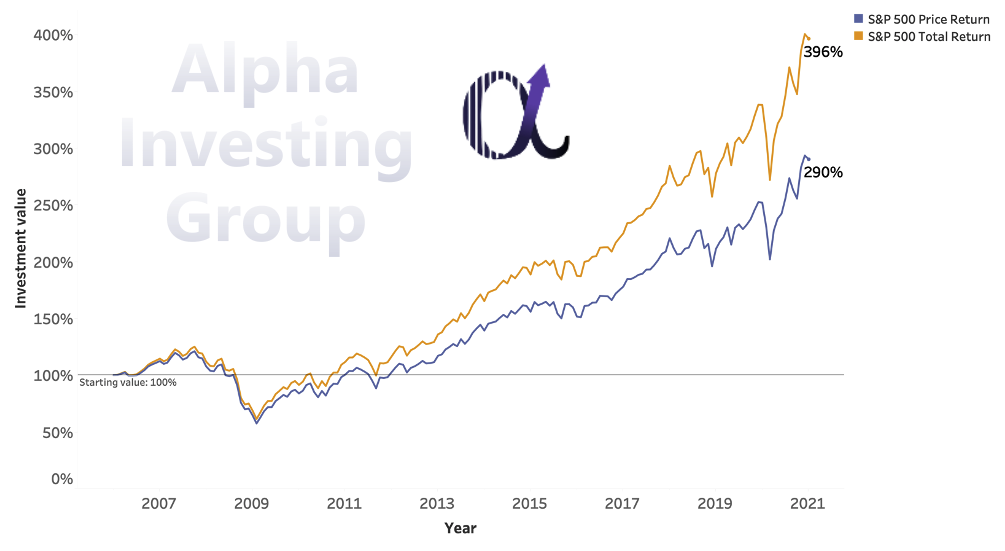

Investing in broad-based indices, such as the S&P 500, often guarantee a constant dividend yield of around 1% to 2%. It may not seem a lot, getting an investment income of merely £12.50 every month by investing £10,000, assuming a 1.5% dividend yield. But again, if we compound it for multiple years, the difference is enormous, as shown in Figure 2.

By reinvesting the dividends into the S&P 500, you would have earned twice the amount than if you did not get the dividends. This is the power of dividends reinvesting.

Figure 4: Comparisons between S&P 500 price return and total return, rebased (from 2006 to 2020), source: investing.com

Conclusion

All in all, the best passive investment is to invest in low-cost broad market index funds, or index ETF for that matter. Moreover, reinvesting your dividends will allow the forces of compounding interest to go to work and earn you impressive returns.

Selecting mutual funds or some stocks that will outperform the market is like trying to find the needle in the haystack – it is almost impossible to get the right one. Hence, passive investors believe the best way to invest is to buy the haystack, which is the entire market portfolio. And the easiest way to do this is to invest in a broad market index fund like the S&P 500.

When investing, it might be tempting to beat the market. However, is it worth the risks if there is only less than a 1% chance of doing that? Is the market return not enough? By investing in S&P 500, you would have almost tripled your return from 2010 to 2020.

As Benjamin Graham once said, “To achieve satisfactory results (the market return) is easier than most people realize; to achieve superior results is harder than it looks.”

Finally, I would emphasize again the importance of time as a factor in passive investing. Like every investing strategy, you could lose money with passive investing in the short term. However, if you are persistent and stick to it for the long term, passive investing could yield incredible results for your investments.

If you are keen to explore further on this topic, please check out The Little Book of Common Sense Investing, written by John Bogle, the founder of Vanguard. It is a must-read if you intend to fully understand the concept of passive investing and develop passive investment ideas of your own.