Best Investment Strategies To Learn for Beginners

By WB Loo | 2022-01-01

This page may contain some affiliate links. This means that, at no additional cost to you, Alpha Investing Group will earn a commission if you click through and make a purchase. Learn more

As Warren Buffet once said, "Risk comes from not knowing what you're doing." In the world of investing, to know what you are doing, you need to have investment strategies of your own. And this article is written for this purpose alone — to help you choose or develop your won investment strategies. By finishing this article, you will be able to:

- Understand what an investment strategy is

- Understand the importance of investment strategies

- Understand the characteristics of different types of investment strategies and the difference between them

- Decide which investment strategies suit you the best

What is an investment strategy, and why do you need (at least) one?

An investment strategy is like your game plan to invest. Investing without strategies is like a basketball team going into a game without a coach or a playbook. Though they are not required, they significantly improve your chances of winning. Here’s why:

-

Investment strategies can tailor your investments to your risk tolerance

Risk tolerance has two components: your ability to take risks and your willingness to take risks (risk attitude).

The ability to bear risk is measured mainly in objective factors, such as time horizon, expected income, and the level of wealth relative to liabilities. For example, an investor with a 20-year time horizon can be considered to have a greater ability to bear risk, other things being equal than an investor with a 2-year horizon. This difference is because, over 20 years, there is more scope for losses to be recovered or other adjustments to be made than over two years.

The willingness to take risks, or risk attitude, is a more subjective factor. It is based on psychological factors, such as personality type, self-esteem, and inclination to independent thinking. Some individuals are comfortable taking financial and investment risks, whereas others find it distressing. Although there is no single agreed-upon method for measuring risk attitude, it is believed that the more financially educated you are, the more willing you will be to take risks.

You can tailor your investments to your risk tolerance by choosing the right investment strategies in the stock market.

-

Investment strategies allow you to form clear and independent investment decisions

The stock market can be a bewildering place. There are thousands of companies, spreading over various sectors and industries, listed in the global equity market. With every company issuing a never-ending stream of information, including corporate news and financial reports, there’s a real danger of "information overload".

Applying a clear investment strategy in the stock market will help you curtail the information overload, as the number of investment possibilities reduces significantly. This will lead you to form better and independent investment decisions.

The 4 Investment Strategies

There are many types of investment strategies. Today, let's look at the four stock investment strategies for beginnersso that you can decide for yourself which are the best for you.

Passive investing

Passive investing is a long-term investment strategy that focuses on growing wealth gradually but consistently. Passive investors believe the market posts a positive return over time. Also known as buy-and-hold, passive investing avoids actively trading securities and seek profit from short-term price fluctuations. This is because passive investors believe it is impossible to outperform the market over the long term. Hence, they choose to invest in well-diversified securities that replicate the market’s performance, such as index funds or ETFs. This is also commonly known as the index investing strategy. One of the most famous index funds is Vanguard’s S&P 500 Index Fund (VOO).

Strengths:

Low fees: Passive funds usually require very low fees as they do not require people to manage them actively. For example, VOO has an expense ratio of 0.04%, compared to the expense ratios of actively managed mutual funds, which can range from 0.25% to 1.5%.

Tax-efficient: Since the passive investing strategy does not require you to buy and sell stocks actively, capital gain taxes are typically lower as you are likely to hold it for more than a year.

Simplicity: Passive investing strategy is easy to implement. Chuck a portion of your salary in and get on with life. Let the market does its magic for you while you are earning more money.

Low barrier of entry: It is needless to say that you don’t need to have a degree in finance to put your money into a broad-market index passively. You also do not need much capital to begin investing with this strategy. With the introduction of ETFs, you can now start investing with as low as $1.

Limitations:

Smaller potential gains: Well, if you merely invest and follow the market, you will never beat it. But then again, do you really need to beat the market to achieve satisfactory results?

Lack of flexibility: Active managers often adopt various complex strategies to hedge their investments or get out of a sector when the risks start piling up, whereas passively investing will not allow you to do that since you are investing in broad-market indices. But will these active investment strategies beat the market? How about after deducting the fees?

Takeaways:

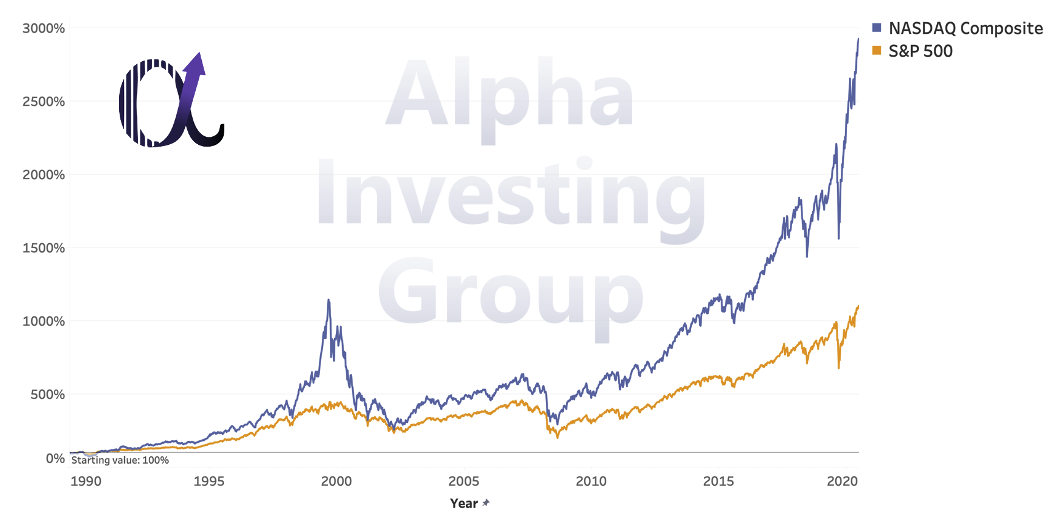

Passive investing is suitable for people who want their money to work for them, not the other way round. And it doesn’t hurt that even investing passively can achieve great profit. If you put $1,000 in the S&P 500 10 years ago, your money is now worth more than $2,000. Your money essentially doubled without having you do anything. Look at Figure 1 to understand the beauty of passive investing.

Figure 1: The 30-year return of S&P 500 and NASDAQ Composite, source: investing.com

Growth Investing

Growth investors are investors who invest primarily in growth stocks, which are expected to grow a lot faster than the market average. They look for investments that offer substantial upside potential when it comes to future earnings of the stock. A lot of people tend to confuse growth investing with speculative investing. In reality, they couldn’t be more different. While speculative investing focuses on price fluctuations, growth investing focuses on the company’s future potential to grow.

Strengths:

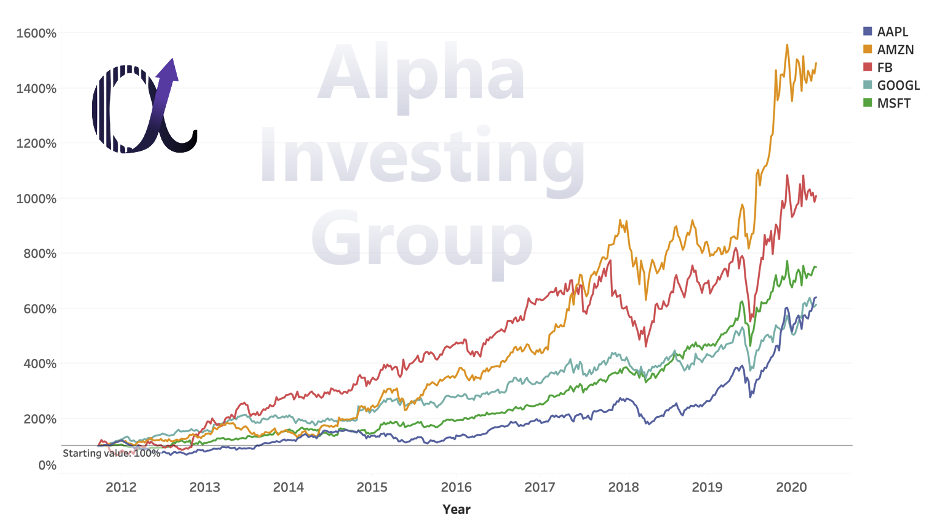

Huge potential upside: Growth investing is a popular investing strategy nowadays, considering the upside potential this investing strategy provides. Just think about it, if you invested $100 in Amazon (AMZN) 10 years ago, the $100 is now worth more than $2,400. That’s more than 2400% of the return.

Exciting: Growth investors are said to be looking for the “next big thing”. Just ask yourself, which is more exciting to analyze — an advanced technology company like Google or a mature, slow-growing tobacco company like Altria Group?

Limitations:

No or minimal dividends: Most growth companies do not give a damn about giving out dividends to their investor. Yet, they are the ones getting chased by investors to invest in them. Why so?

This is because growth companies tend to reinvest all their earnings in further growing the companies. The companies and their investors believe that this will increase the share price by more than the dividends, hence achieving a better return on investment (ROI) for the shareholders.

High risk: Growth companies always have a higher valuation and P/E ratios due to their fast earnings growth. This makes this investing strategy risky. As the speed of the earnings growth highly supports the valuation and stock price, missing earnings expectations might negatively impact on the stock prices.

Takeaways:

The growth investing strategy can bring huge returns, but it requires a detailed analysis of the companies and the outlook and the prospect of the sector and industry the companies are in. It is also essential to understand the companies' management teams well as they are the ones who will decide if the growth rates are sustainable.

Figure 2: The 8-year return of Microsoft (MSFT), Alphabet (GOOGL), Apple (AAPL), Facebook (FB), and Amazon (AMZN), source: investing.com

Value Investing

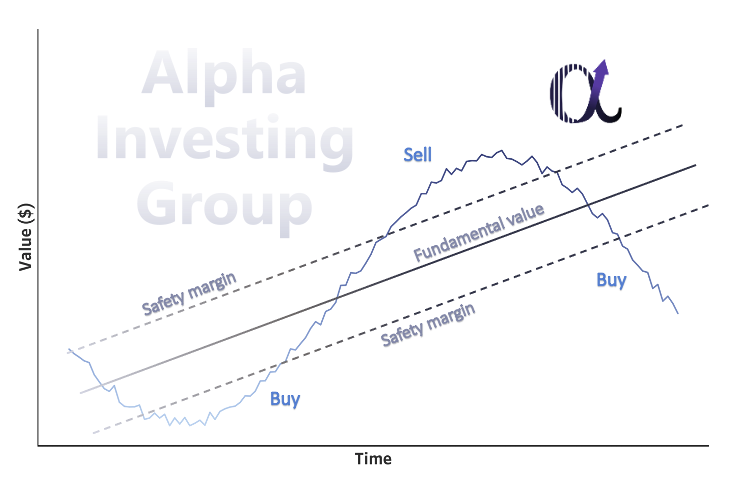

Value investing is about investing in undervalued stocks. This strategy aims to earn profits when the prices converge to their intrinsic values. In essence, value investors look for stocks that are ‘cheap’.

Value investors believe that the market is not entirely efficient, and investors behave irrationally, leading to some stock prices not fully reflecting their underlying values.

Value investors invest not in the stock but in the business itself. They believe in the business, from production to distribution channels to management teams and even industry outlooks. Thus, they are required to understand the business and the industry thoroughly.

Warren Buffett is often seen as the epitome of value investors. He does not buy stocks often and definitely does not trade them actively. Instead, he does his homework thoroughly for a long time, sometimes for a couple of years, before he goes all in and stays committed for more than a decade.

Figure 3: Illustration of value investing, source: Alpha Investing Group

Strengths:

Low risk: If the stock is evaluated properly and an appropriate margin of safety is applied, the value investing strategy has minimal loss-associated risk as this strategy focuses on selecting stock at a discount. Value investors tend to seek well-established large-cap companies that are undervalued. Hence, low volatility is expected.

Dividends return: Well-established large-cap companies usually distribute dividends to shareholders regularly. Since Total return = Capital appreciation + dividends, investing in these companies allows investors to get exposed to 2 forms of return.

Limitations:

Patience: Investing, and especially value investing, is not for quick money. You need to understand that you are in it for the long run. It is important to realize that, no matter how accurate your analysis is, you wouldn’t realize profits until the market agrees with you. Sometimes you will need to hold your positions for years until the market turns in your favor.

Intrinsic value is difficult to estimate: Undervalued companies are challenging to identify. More than 3,500 stocks are currently trading on the US stock exchange alone. Finding undervalued companies worth investing in can be like finding a needle in a haystack, not to mention that it is even more challenging to estimate their respective intrinsic values. It requires a certain level of expertise that not every investor has. But rest assured, you are already one step ahead as Alpha Investing Group aims to provide tools and knowledge to allow investors like yourself to analyze and make sound investment decisions independently.

Takeaways:

Value investing strategy can work so long as the investor understands the business well enough and sets an appropriate margin of safety before buying in the position. You also need to have the mental capabilities to hold their positions for the long term and see through the ebbs and flows of the market. According to Dodge & Cox, value investing almost always outperforms growth investing if investors hold their position for more than a decade.

Dividend Investing

The dividend investing strategy, also known as the income investing strategy, focuses on stocks that pay out high and consistent dividends. This strategy allows investors to get returns by both capital appreciation and dividend income.

Dividend investing is deemed to be a relatively low-risk investment strategy. One of the reasons is that companies with a long history of giving out dividends will do all they can to continue doing that since doing otherwise will negatively impact their share price. This makes the dividend aristocrats (companies that maintain or increase their dividend for more than 25 years) extremely attractive as these companies have been paying out dividends going through various market conditions. Due to these reasons, dividend investing is also considered one of the best retirement investment strategies.

Strengths:

Potential source of passive income: Most companies with a long history of paying dividends will do all they can to continue doing so as otherwise would cause a lot of shareholders selling hence heavily impacting the share price. The income investing strategy can thus be a very reliable source of passive income and retirement investment strategy if you pick the right company.

Have a resilient portfolio: Most dividend aristocrats also tend to be large blue-chip companies that have stood the challenge of bad market conditions and are able to weather significant market fluctuations.

Reinvesting dividends could yield amazing results: Compounding interest is said to be the eighth wonder of the world. Just reinvest your dividends and behold the magic.

Limitations:

Dividends are not guaranteed: Companies may suspend or cut their dividends if the market condition worsens or does not perform well. Hence, it is vital to analyse the company in detail before putting your money into it.

Dividends companies may be slow-growing: Since it is commonly believed that companies should only pay out dividends if they have no better use of the money, dividends companies may be ‘outdated’ in some investors’ eyes.

Takeaways:

Dividend investing is a long-term investment strategy. You got in, and you want to receive the dividends over time. Although the dividend pays out by a stock may be insignificant, the amount does add up. After considerable investments, you will be looking at more than £1,000 and above every month from just receiving dividends. Thus, it is crucial not only to pick stocks that pay an attractive dividend, but also to pick companies that have the ability to pay out the dividends consistently.

Choosing the best investment strategies

After learning about the four stock investment strategies for beginners, you probably wonder which investment strategy is the best. However, there is no answer to the question as no one investment strategy is the best overall. The question that you should ask is: How do I select the best investment strategy for me?

To put it bluntly, there is no right way to choose the right investment strategies. However, there are a few factors that you MUST consider before deciding which investment journey you wish to embark on.

-

What is your investment goal?

The first thing that you should consider is your investment goal. A retirement investment strategy will be completely different from one to buy a car or a house. Needless to say, if you don't understand your goals before you start investing, everything else that follows will go awry.

-

What is your investment horizon?

It is important to know the amount of time you plan to invest your money before deciding which investment strategy you should choose. You would never want to be in a situation when you are forced to sell your investment at some suboptimal prices just because you need the money to get by.

-

What is your risk tolerance?

As for risk tolerance, just ask yourself two questions.

- How much money can you afford to lose?

- How much money are you willing to risk?

If it's not much, go for the safer ones. Safer investment strategies like passive investing can also bring you lucrative returns if you invest the right way. However, if you can and are willing to risk more money, choosing riskier investment strategies can potentially bring not just higher returns, but also more joy along the way.

-

What are your strengths and weaknesses?

Understanding yourself is of the essence in investing. This is because you want to play your strengths and limit your weaknesses when investing your money. For example, suppose you are well-versed in financial literacy and are able to carry out your own financial analysis. In that case, it might be better for you to go for more complex investment strategies like growth investing and value investing, as you can probably earn a lot more than just indexing. However, if you are very busy and do not have time to analyze many investment opportunities, settling for passive investing is not a bad choice at all.

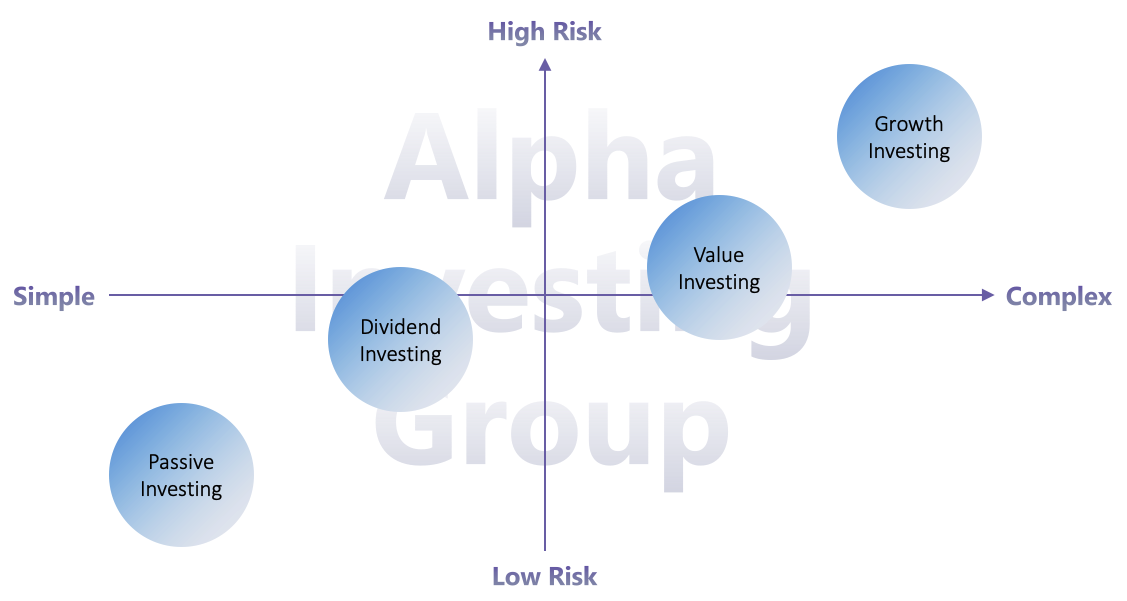

The figure below gives you an overview of the four investment strategies discussed. It categorizes the investment strategies according to their riskiness and complexity. If you are ever in doubt, just refer to this figure.

Figure 5: The complexity-riskiness matrix of the 4 investing strategies, source: Alpha Investing Group

Conclusion

In a nutshell, although it is a must to understand your investment strategies before you start your investing journey, I would recommend you spend at least some time assessing which strategies are the best for you. I can't stress enough the importance of understanding your strengths, limitations, and current circumstances and choosing an investment strategy that will complement them.

Lastly, if you are interested in knowing more about the investment strategies mentioned above or other related topics, please do leave your comments below. Also, please don't hesitate to give feedback. We are dedicated to producing the best content for you.